Choosing an insurance company isn’t just about finding the cheapest premium. You’re trusting them with something crucial—being there when crisis strikes, whether that’s a car accident, burglary, medical emergency, or death in the family. The wrong insurer can turn a difficult situation into a nightmare of rejected claims and endless phone calls.

South Africa’s insurance market is worth over R580 billion annually, with more than 80 registered insurers competing for your business. Not all are created equal. Some have been around for over a century, building solid reputations. Others are new players disrupting the market with technology and better service. Some pay claims quickly and fairly. Others look for every possible reason to deny payouts.

According to the Financial Sector Conduct Authority’s 2024 complaint statistics, South African consumers lodged over 48,000 complaints against insurers last year. The gap between the best and worst performers is staggering—some companies resolve 95% of claims smoothly while others have rejection rates exceeding 30%.

This list focuses on insurers who actually deliver when you need them most. These companies have strong financial stability, fair claim practices, reasonable premiums, and customer service that doesn’t make you want to throw your phone against the wall.

What Makes an Insurance Company Trustworthy?

Before diving into the list, let’s establish what “trusted” actually means in practical terms.

Financial Strength

Your insurer needs to be around in 20 years when you claim on that life policy you’re buying today. Companies with poor financial health might offer cheap premiums now but collapse when mass claims hit—leaving you with worthless policies.

We’ve considered financial ratings from agencies like Global Credit Rating, expertise assessments, and solvency ratios. Companies on this list have solid financial foundations capable of weathering economic storms.

Claim Settlement Ratios

This is the percentage of claims an insurer approves versus rejects. Industry average sits around 85-90%. The best performers exceed 93-95%, meaning they find ways to pay legitimate claims rather than looking for technicalities to deny them.

Data comes from ASISA (Association for Savings and Investment South Africa) reports, company disclosures, and customer complaint patterns analyzed through the Ombudsman for Long-term Insurance and the Ombudsman for Short-term Insurance.

Speed of Claim Processing

A company might eventually pay your claim, but if it takes six months, they’ve failed you. The best insurers process straightforward claims within 48-72 hours for short-term insurance and 5-10 days for life insurance.

Customer Service Quality

When you need to update your policy, query a premium increase, or check coverage details, can you actually reach someone who helps? Or do you navigate phone menus endlessly before being disconnected?

We’ve examined Hello Peter reviews, Google ratings, social media responsiveness, and Ombudsman complaint data to assess real customer experiences beyond marketing promises.

Product Range and Flexibility

Trusted insurers offer comprehensive products covering various needs—car, home, life, health—with flexibility to customize. They don’t force you into rigid packages that include cover you don’t need.

Transparency and Fair Pricing

No hidden fees. Clear explanation of what’s covered and what’s not. Premium increases that make sense and are communicated properly. These seem basic but many insurers fail here.

Digital Capability

In 2025, you should be able to get quotes, purchase policies, make payments, submit claims, and track everything through apps or websites. Companies stuck in 1995 operationally don’t make this list.

The Top 10 Trusted Insurance Companies

1. Old Mutual

Founded: 1845 (180 years in South Africa)

What they cover: Life insurance, funeral cover, investments, savings, group schemes, car and home insurance (through partnerships)

Why they’re trusted:

Old Mutual is South Africa’s oldest insurer, and they’ve survived nearly two centuries by actually paying claims and treating customers fairly. Their claim settlement ratio sits at 96.4%—among the highest in the industry for life insurance.

They insure over 4.2 million South Africans across various products. Their greenlight programme specifically targets lower-income markets with accessible funeral and life cover from R29 monthly, making insurance available to people often excluded by traditional providers.

The complaints-to-policy ratio is one of the lowest in the industry. According to 2024 Ombudsman data, Old Mutual receives approximately 2.3 complaints per 10,000 policies—well below the industry average of 4.7.

What customers appreciate most is their claims process. For life insurance, straightforward death claims are processed within 7-10 days on average. Their maturity payouts (when policies reach their term) happen automatically—money arrives in your account on the due date without you needing to chase them.

Their weakness? They’re not always the cheapest. You’ll often pay 10-15% more than newer digital insurers for equivalent cover. But many customers accept this premium for the certainty that claims will be paid without drama.

Best for: Life insurance, retirement products, funeral cover, people wanting an established company with proven track record

Customer service: 8/10 – Professional but can be slow during peak periods

Digital experience: 7/10 – Functional app and website but not as slick as newer players

2. Santam

Founded: 1918

What they cover: Car, home, business, commercial, agricultural, personal liability, all-risk items

Why they’re trusted:

Santam dominates short-term insurance in South Africa with a 23% market share. They insure roughly 1.8 million vehicles and over 800,000 homes. They’re big because they’re good, not good because they’re big.

Their claim approval rate is 94.7%, and they’ve invested heavily in speeding up the process. For vehicle accidents, their average claim turnaround is just 4.8 days from report to repair authorization. Many simple claims get approved within 24 hours.

Santam operates the largest network of approved repairers in South Africa—over 1,200 panel beaters, glass specialists, and mechanics. This means you have genuine choice when claiming, not being forced to use one distant workshop.

They pioneered agricultural insurance in South Africa and remain the trusted name for farmers. Their expertise in crop insurance, livestock cover, and farm equipment protection is unmatched. If you farm, Santam should be on your shortlist.

The company’s solvency ratio sits at a healthy 38% (anything above 15% is considered stable), meaning they have substantial reserves to handle even catastrophic claim events like natural disasters.

Where Santam shines is complex claims. A client’s house burned down completely—Santam had assessors there within 12 hours, approved emergency accommodation immediately, and settled the full claim within three weeks. They don’t look for excuses when major losses occur.

Best for: Vehicle insurance, home and building insurance, business and commercial cover, agricultural insurance

Customer service: 9/10 – Responsive, knowledgeable call centre agents

Digital experience: 8/10 – Solid app with good claim submission tools

3. Discovery

Founded: 1992

What they cover: Health insurance (medical schemes), life insurance, car insurance, home insurance, business insurance, travel insurance

Why they’re trusted:

Discovery revolutionized South African insurance by introducing the Vitality rewards model—behave healthily and safely, reduce your premiums and earn benefits. Their model has been copied globally because it works.

They insure over 3.5 million lives across various products. Their health insurance (Discovery Health Medical Scheme) is South Africa’s largest open medical scheme with over 2.7 million members.

What makes Discovery trusted isn’t just their innovation but their claims performance. Discovery Life has a 97.2% claim approval rate—the highest among major life insurers. They paid out R8.7 billion in claims in 2024 alone.

Their car insurance is particularly impressive. The DQ Track system monitors your driving through telematics. Safe drivers genuinely save up to 50% on premiums—this isn’t marketing hype. Customers regularly achieve these savings by maintaining high DQ Track scores.

Discovery’s claims process is technology-driven. Submit a car accident claim through the app with photos—AI assesses damage and provides instant repair estimates for minor accidents. You can book approved repairers directly through the app. For straightforward incidents, claims are approved and repairs authorized within 2-3 hours.

Their Vitality integration is either brilliant or annoying depending on your perspective. Earn points by exercising, getting health checks, and buying healthy food. Redeem for flights, Apple watches, fuel discounts, and premium reductions. If you’re willing to engage with the system, value is substantial. If you just want insurance without gamification, it can feel like work.

Complaints mainly center on complexity. Discovery products have many features, options, and terms. Understanding what you’re buying requires attention. Their call centre agents are generally excellent at explaining, but you need to ask the right questions.

Best for: Health insurance, life insurance with rewards, car insurance for safe drivers, comprehensive insurance across multiple needs

Customer service: 8/10 – Knowledgeable but wait times can be long

Digital experience: 9/10 – Excellent app with extensive self-service options

4. Hollard

Founded: 1980

What they cover: Car, home, business, specialized insurance (travel, events, gadgets), group schemes, microinsurance

Why they’re trusted:

Hollard is South Africa’s largest privately-owned insurer, and their independence shows in how they operate. They’re not beholden to shareholders demanding ever-increasing profits, allowing them to focus on long-term customer relationships.

They pioneered microinsurance in South Africa, bringing affordable cover to low-income communities. Their funeral insurance products have protected over 2 million South Africans who previously had no insurance access.

Claim settlement ratio sits at 93.8%, and they’re known for fair assessments. Hollard tends to interpret policy ambiguities in the customer’s favor rather than looking for exclusions—a refreshing approach that builds trust.

Their partnership model is unique. Hollard underwrites insurance for many banks, retailers, and other organizations. If you have insurance through your bank or favorite store, there’s a reasonable chance Hollard is the actual insurer behind the scenes.

What customers praise most is their willingness to pay claims that technically could be contested. One customer’s teenage son crashed the car while his learner’s license was expired by two days. Hollard could have rejected the claim based on this technicality—instead, they paid it, explaining that the spirit of the policy was to cover young drivers, and a two-day administrative delay didn’t change the fundamental risk.

Their specialized insurance products are comprehensive. If you need event insurance for a wedding, travel insurance with excellent coverage limits, or insurance for unusual items like musical instruments or sports equipment, Hollard has refined products that actually work.

Best for: Specialized and niche insurance needs, microinsurance for low-income households, group schemes, ethical insurance approach

Customer service: 8/10 – Friendly and solution-oriented

Digital experience: 7/10 – Functional but less advanced than tech-first competitors

5. Sanlam

Founded: 1918

What they cover: Life insurance, investments, retirement annuities, medical aid gap cover, personal loans, funeral cover, unit trusts

Why they’re trusted:

Sanlam is one of South Africa’s financial giants, managing over R1.4 trillion in assets. They’re a serious player with serious financial backing—your policy is safe with them.

They insure approximately 2.8 million South Africans across life and investment products. Their funeral cover specifically reaches over 1.2 million policyholders, making them one of the largest funeral insurers in the country.

Claim approval rate is 95.8% for life products. Average payout time for straightforward death claims is 8-12 days—reasonable given the documentation required for life insurance. Their terminal illness benefit payouts (when someone is diagnosed with terminal conditions) typically process within 10-14 days, providing crucial financial support when families need it most.

Sanlam Reality, their direct insurance brand, targets younger, tech-savvy customers with simplified products and lower premiums. It’s Sanlam’s acknowledgment that traditional insurance models need disruption—and they’re disrupting themselves rather than waiting for others to do it.

What separates Sanlam is their financial planning integration. They don’t just sell insurance—they help you understand how insurance fits into broader financial strategy. Their advisors (when you use them) take holistic views, ensuring you’re not over-insured in one area while dangerously exposed in another.

Their investment products consistently perform well. Sanlam unit trusts and retirement annuities deliver competitive returns, making them a good choice if you want insurance and investments with one provider.

The main complaint is that Sanlam can feel corporate and impersonal. You’re a policy number more than a person. For some, this doesn’t matter—reliable, professional service is enough. Others prefer warmer, more personal interactions.

Best for: Life insurance, retirement planning, investments alongside insurance, comprehensive financial planning

Customer service: 7/10 – Professional but sometimes impersonal

Digital experience: 8/10 – Strong digital tools and app functionality

6. Momentum Metropolitan

Founded: 1987 (Momentum), merged with Metropolitan in 2010

What they cover: Life insurance, health insurance, investments, short-term insurance, employee benefits

Why they’re trusted:

Momentum Metropolitan (usually just called Momentum) serves over 2.5 million clients and paid out R44 billion in benefits and claims in 2024. Those numbers reflect scale and financial capability.

Their claim settlement ratio is 96.1%—consistently in the top tier. What’s particularly impressive is their life insurance claim turnaround: 72% of claims are paid within 5 days of receiving all required documents. For grieving families needing funds quickly, this speed matters enormously.

Momentum Multiply (their rewards program similar to Discovery’s Vitality) offers tangible benefits. Members earn points for healthy behaviors and safe driving, redeeming for groceries, fuel, flights, and insurance discounts. The program isn’t as extensive as Discovery’s but is simpler—many people prefer this streamlined approach.

Their health insurance products (Momentum Health) offer excellent hospital plans with comprehensive coverage and reasonable premiums. The day-to-day health savings accounts are flexible, and members report good experiences with claims.

Where Momentum particularly excels is group schemes and employee benefits. If your employer offers life insurance, income protection, or retirement savings through Momentum, you’re in good hands. Their corporate service is professional and efficient.

Momentum has invested significantly in digital transformation. Their app allows comprehensive self-service—updating beneficiaries, checking claim status, managing investments, downloading policy documents, all without calling anyone.

The company’s weakness is inconsistency. Some customers report stellar service; others experience frustrations. This suggests service quality varies between departments or individual agents. When you get a good Momentum agent or call centre rep, the experience is excellent. When you don’t, it’s average.

Best for: Life insurance, employee benefit schemes, health insurance, rewards-based insurance model

Customer service: 7/10 – Variable quality depending on who assists

Digital experience: 8/10 – Good app with comprehensive features

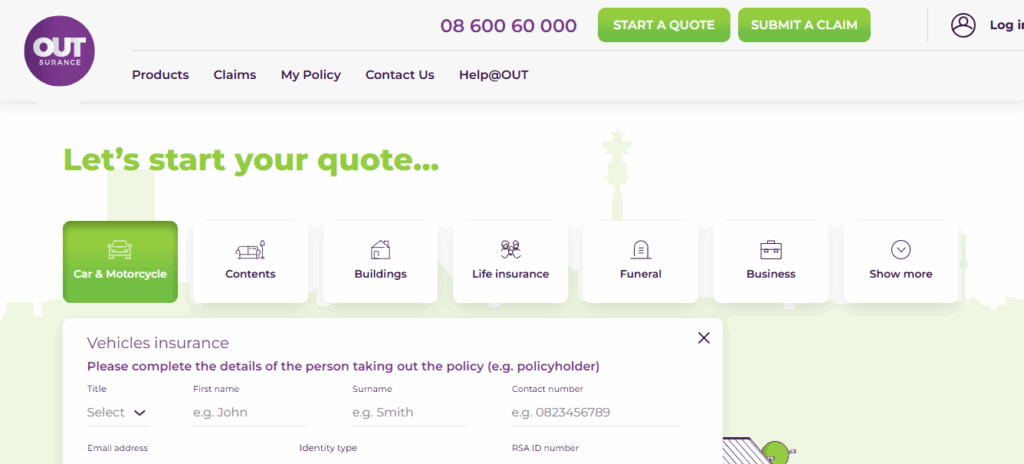

7. Outsurance

Founded: 1998

What they cover: Car, home, motorcycle, commercial vehicle, business insurance

Why they’re trusted:

Outsurance built its reputation on a simple promise: first-class service, no excuses. They’ve largely delivered on that promise for 27 years.

They insure over 1.2 million vehicles and approximately 450,000 homes. Their market share has grown steadily because customers stay—their retention rate exceeds 85%, among the highest in short-term insurance.

Claim approval sits at 94.2%, and their average claim processing time is 5.7 days. Their network of approved repairers is extensive, giving you genuine choice when claiming.

What makes Outsurance different is their approach to premiums. Your premium reduces (through “Outsurance ‘ments”) the longer you’re with them without claiming, and when your possessions depreciate. A car insured for R300,000 today might need only R220,000 cover in five years—Outsurance automatically reduces premiums to match.

Their fixed excess model is clever. You choose your excess when taking out insurance, and that excess never increases, regardless of how many claims you make. This contrasts with many insurers who impose penalty excesses after claims, sometimes making policies unaffordable.

The O-Sure Score (their telematics driving monitor) rewards safe driving with premium discounts. It’s less invasive than Discovery’s system—you choose when to use it, earn your discount, and can then switch it off. For cautious drivers, it’s an easy way to reduce premiums by 15-25%.

Customer service is their biggest strength. Outsurance’s call centres are South African-based, agents are empowered to make decisions without endless escalations, and hold times are generally short. When you call, someone helpful answers quickly—a rarity in insurance.

The main limitation is product range. Outsurance doesn’t offer life, health, or travel insurance—only short-term property and liability products. If you want one insurer for everything, look elsewhere. But for what they do offer, they do it exceptionally well.

Best for: Car insurance, home insurance, customers valuing excellent service, rewards for loyalty

Customer service: 9/10 – Consistently good, empowered agents

Digital experience: 7/10 – Functional but less advanced than newest players

8. Naked Insurance

Founded: 2018

What they cover: Car insurance, home insurance

Why they’re trusted:

Naked is South Africa’s first fully digital insurer, and they’ve disrupted the market by actually doing what they promised—transparency, low prices, and fast claims.

Despite being relatively new, they’ve already insured over 70,000 vehicles and homes. Their growth rate is remarkable—300% year-over-year since launch—because they’ve solved problems customers hated about traditional insurance.

Their model is simple: Take a flat 20% fee upfront, insure you with that money, and if there’s anything left at year-end (because claims were lower than expected), donate it to charity or refund it to customers. This removes the incentive to deny claims—Naked doesn’t profit from rejections.

They’ve donated over R12 million to South African charities since launch, money that would typically be insurer profit. Customers appreciate knowing excess premiums support good causes rather than shareholders.

Claim approval rate is 96.8%—exceptional for a short-term insurer. Average claim processing time is 2.3 days, and many minor claims are approved within hours. Their AI assesses damage from photos you submit, giving instant repair estimates.

Everything happens through their app. Get quoted, purchase insurance, manage policies, submit claims, track progress, all without calling anyone. The app has a 4.6-star rating on both iOS and Android—rare for an insurance app.

Their telematics for car insurance is sophisticated. The app monitors driving, and safe drivers save up to 40% on premiums. Unlike some competitors, Naked is transparent about what they track and how it affects pricing.

The limitations? They only offer car and home insurance—nothing else. And because they’re new, some customers are nervous about their long-term stability. However, they’re backed by Greenlight Re, a major reinsurer with substantial assets, providing financial security.

Naked isn’t for everyone. If you want someone you can call and chat with about your policy, they’re not ideal. If you’re comfortable managing everything digitally and want transparency and low prices, they’re excellent.

Best for: Tech-savvy customers, people wanting transparent pricing, those comfortable with digital-only interaction, safe drivers seeking rewards

Customer service: 7/10 – Excellent digital support, but no phone option frustrates some

Digital experience: 10/10 – Best insurance app in South Africa

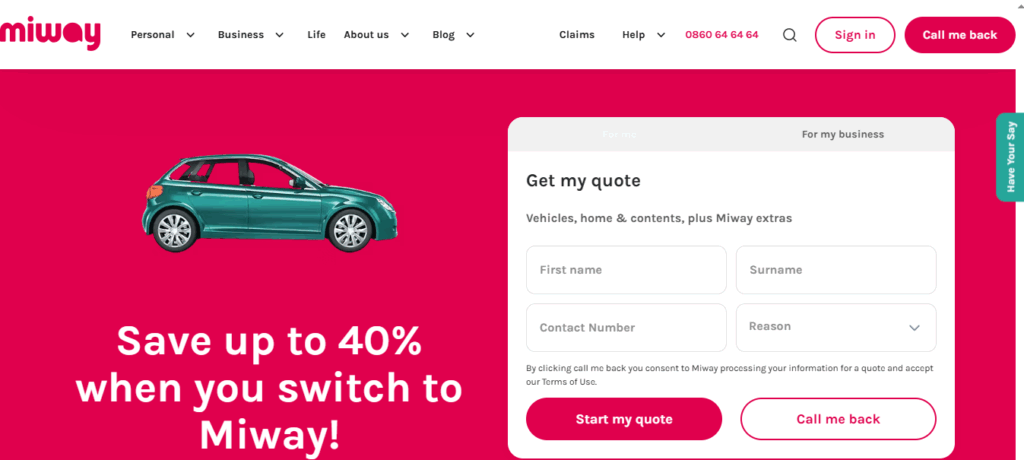

9. MiWay

Founded: 2008

What they cover: Car, home, motorcycle, business, commercial, caravan and trailer, golf cart

Why they’re trusted:

MiWay positioned themselves as the “challenger brand” taking on established insurers with better service and fairer pricing. Seventeen years later, they’ve largely succeeded, insuring over 500,000 policies.

Their claim approval rate is 93.4%, and they’ve reduced average processing time to 6.2 days through digital claims tools. Their AI-assisted damage assessment provides instant estimates for many vehicle claims, speeding up the entire process.

What customers love is their fixed excess product. You choose your excess level, and it never increases—even if you claim multiple times. This predictability helps with financial planning and removes the fear that one accident will make insurance unaffordable.

MiWay’s partnership with approved repair networks is extensive. They’ve contracted over 800 repairers nationwide, and you can book directly through their app. Many repairs are authorized before you even drop your vehicle off, eliminating delays.

Their premiums are competitive—typically 10-15% below traditional insurers for equivalent cover. They achieve this through efficiency: digital-first processes, automated underwriting, and reduced reliance on expensive broker networks.

MiWay’s roadside assistance (included with car insurance) is excellent. They responded to over 18,000 callouts in 2024, with average arrival times under 35 minutes in urban areas. Whether you’ve had a flat tire, run out of fuel, or broken down, help arrives quickly.

Customer service quality is good but not exceptional. Call centre wait times can be lengthy during peak periods, and complaint resolution sometimes requires persistence. They’re not bad—just not as consistently excellent as Outsurance or Discovery.

The company’s digital tools have improved significantly. Their new app (launched 2024) is vastly better than the previous version, offering comprehensive self-service and intuitive design.

Best for: Car insurance with fixed excess, affordable premiums without sacrificing cover quality, roadside assistance

Customer service: 7/10 – Good when you reach them, but wait times can frustrate

Digital experience: 8/10 – Much improved recently

10. King Price

Founded: 2011

What they cover: Car, home, motorcycle, golf cart, caravan and trailer, business

Why they’re trusted:

King Price’s unique selling point is simple and brilliant: Your premium decreases every month as your possessions depreciate. Unlike other insurers who lock you into annual premiums regardless of depreciation, King Price adjusts monthly.

This model appeals to people’s sense of fairness. Why should you pay the same for a car worth R250,000 today and R210,000 in twelve months? King Price adjusts the premium to match, saving customers meaningful money over time.

They insure approximately 400,000 policyholders across various products. Their retention rate exceeds 80%—people stay because the model delivers genuine value.

Claim settlement ratio is 92.8%—solid if not exceptional. Processing times average 6.8 days, with many straightforward claims resolved faster. They’ve invested in digital claim submissions, allowing you to photograph damage and submit through their app.

King Price’s Garage feature is clever—a digital space where you store all vehicle information, service history, modifications, and documents. When claiming, everything the insurer needs is already there, speeding up the process.

Their premiums start competitively but because they decrease monthly, you save substantially over policy life. Customers report premium reductions of 15-25% over three years while maintaining the same coverage.

Customer service is friendly and solution-focused. Their call centre is South African-based, and agents generally show willingness to help rather than creating obstacles. They’re not the fastest to answer during busy periods, but once connected, service quality is good.

The main weakness is that decreasing premiums, while fair, mean your coverage also decreases as possessions depreciate. If you want level cover where your payout remains constant regardless of depreciation, King Price’s model doesn’t suit you.

Additionally, their app and digital tools, while functional, lag behind newer competitors like Naked. They’ve improved significantly but still feel slightly dated compared to cutting-edge digital experiences.

Best for: Car insurance with reducing premiums, home insurance, people wanting fair pricing that reflects depreciation

Customer service: 8/10 – Friendly and helpful

Digital experience: 7/10 – Functional but could be more modern

Honorable Mentions Worth Considering

1Life

Direct life insurer with no brokers, meaning lower premiums. Excellent for straightforward life and funeral cover. Their app-based approach appeals to younger customers. Claim approval is strong at 94.7%, and digital processes are smooth.

Best for: Basic life and funeral insurance at competitive prices without broker fees

Pineapple

Peer-to-peer insurance model where you join groups and share premiums. Leftover money gets returned if claims are low. Innovative approach with transparent pricing. Still relatively small but growing quickly with positive customer feedback.

Best for: Innovative approach to insurance, potential cashback, transparent community model

Clientèle

Specializes in life insurance, funeral cover, and legal insurance. They target middle and lower-income markets with accessible products and simple applications. Strong presence in rural areas where traditional insurers often ignore customers.

Best for: Funeral cover, legal insurance, accessible products for lower-income households

Auto & General

Budget-focused short-term insurance with competitive premiums. They don’t offer premium service but deliver solid basic cover at low prices. Good option if price is your primary concern and you’re comfortable with no-frills service.

Best for: Budget car and home insurance, cost-conscious customers

Budget Insurance

Another affordable option for short-term cover. They’re particularly strong in used vehicle insurance and providing cover for older cars that premium insurers often reject or charge excessively for.

Best for: Insuring older vehicles, budget-friendly short-term cover

How to Choose the Right Insurer for You

Match the Insurer to Your Priority

If you want the absolute cheapest premiums and are comfortable managing everything digitally, Naked or 1Life make sense.

If you value personal service and speaking to helpful humans when needed, Outsurance or Santam are better choices.

If you want rewards for healthy living and safe driving, Discovery or Momentum offer comprehensive programs.

If you want an established company with decades of proven reliability, Old Mutual or Sanlam provide that certainty.

Check What They Actually Cover

Two policies might seem similar but have different exclusions or coverage limits. A cheaper policy that excludes hail damage in a hail-prone area is false economy.

Read policy documents carefully. If anything is unclear, ask before purchasing. The best insurers explain clearly; poor ones use confusing jargon intentionally.

Test Their Customer Service Before Committing

Call their customer service line with a question before purchasing. How long do you wait? Are agents helpful? Do they answer your question clearly, or give vague responses that don’t actually help?

This simple test reveals a lot about how they’ll treat you when you’re a customer needing urgent assistance.

Look at Recent Reviews

Insurance companies change. An insurer excellent three years ago might have deteriorated as they grew. Check recent reviews (past 6-12 months) on:

- Hello Peter

- Google Reviews

- Facebook page comments

- The Ombudsman’s website (for formal complaint data)

Look for patterns. One angry review might be an anomaly; dozens mentioning the same issue indicate a real problem.

Consider the Total Relationship

If you want car, home, and life insurance, using one company simplifies administration and sometimes earns multi-policy discounts. But don’t force this if one company is mediocre at something—better to have three excellent policies from three insurers than three average ones from one.

Verify Financial Stability

Check the insurer’s financial ratings. Companies rated BB+ or higher by Global Credit Rating are generally stable. Anything below B- raises concerns about long-term viability.

For newer companies, check who backs them. Naked is backed by Greenlight Re. Pineapple partners with Hollard. This backing provides financial security even though the brand itself is new.

Red Flags That Should Make You Avoid an Insurer

Excessive Complaints

Check the Ombudsman for Long-term Insurance and Ombudsman for Short-term Insurance annual reports. They publish complaint ratios by company. Insurers with complaint rates double the industry average have systemic problems.

Pressure Sales Tactics

Reputable insurers don’t pressure you to buy immediately. If someone tells you “this offer expires today” or makes you feel rushed, walk away. Quality insurance doesn’t require high-pressure tactics.

Unclear Pricing or Terms

If you can’t get a straight answer about what something costs, what’s covered, or what happens when you claim, that’s deliberate. Good insurers explain clearly because they have nothing to hide.

Poor Online Presence

In 2025, every legitimate insurer should have a functional website, active social media responding to queries, and reasonable online reviews. An insurer with minimal web presence or exclusively negative reviews should be avoided.

Unsolicited Contact

If someone calls you out of the blue offering insurance, be extremely cautious. Reputable insurers don’t cold-call. Many scams operate this way—you pay premiums to fake policies with companies that don’t exist.

Too Good to Be True Pricing

If one quote is 40% cheaper than all others for identical cover, something’s wrong. Either coverage isn’t actually equivalent (check exclusions carefully), or the company is financially unstable and pricing unsustainably.

What to Do If Your Current Insurer Isn’t on This List

Don’t panic and immediately cancel. But do this:

Review Your Policies Carefully

Check what you’re actually covered for, what you’re paying, and whether it still meets your needs.

Get Quotes from Top-Rated Alternatives

Compare what you’re currently paying against what trusted insurers would charge for equivalent cover.

Check Your Insurer’s Recent Performance

Look at recent reviews and complaint data. Maybe they’re not on this list but still perform reasonably. Or perhaps you discover problems you weren’t aware of.

Make an Informed Decision

If your current insurer is significantly more expensive than alternatives with no apparent benefit, switching makes sense.

If they’re cheaper or you’ve had genuinely good service from them, staying might be fine—this list isn’t exhaustive of all decent insurers.

Don’t Let Policies Lapse When Switching

Ensure new coverage is active before canceling old policies. There should be zero gap in coverage—that’s when Murphy’s Law ensures something happens.

The Bottom Line

South Africa has excellent insurance companies that genuinely protect customers and pay claims fairly. The ten listed here have proven track records, financial stability, reasonable pricing, and service quality that justifies trusting them with your financial security.

Your ideal insurer depends on your specific needs, budget, and preferences. Someone wanting maximum digital convenience will choose differently than someone valuing personal relationships with agents. Both can find excellent options on this list.

What matters most is having appropriate cover from a company that will actually be there when you need them. Every one of these ten insurers delivers on that fundamental promise.

Don’t stay with a poor insurer out of inertia. Get quotes, compare properly, and move to a company that deserves your business. Your future self—during that stressful moment when you need to claim—will thank you for choosing wisely.

Reads also: